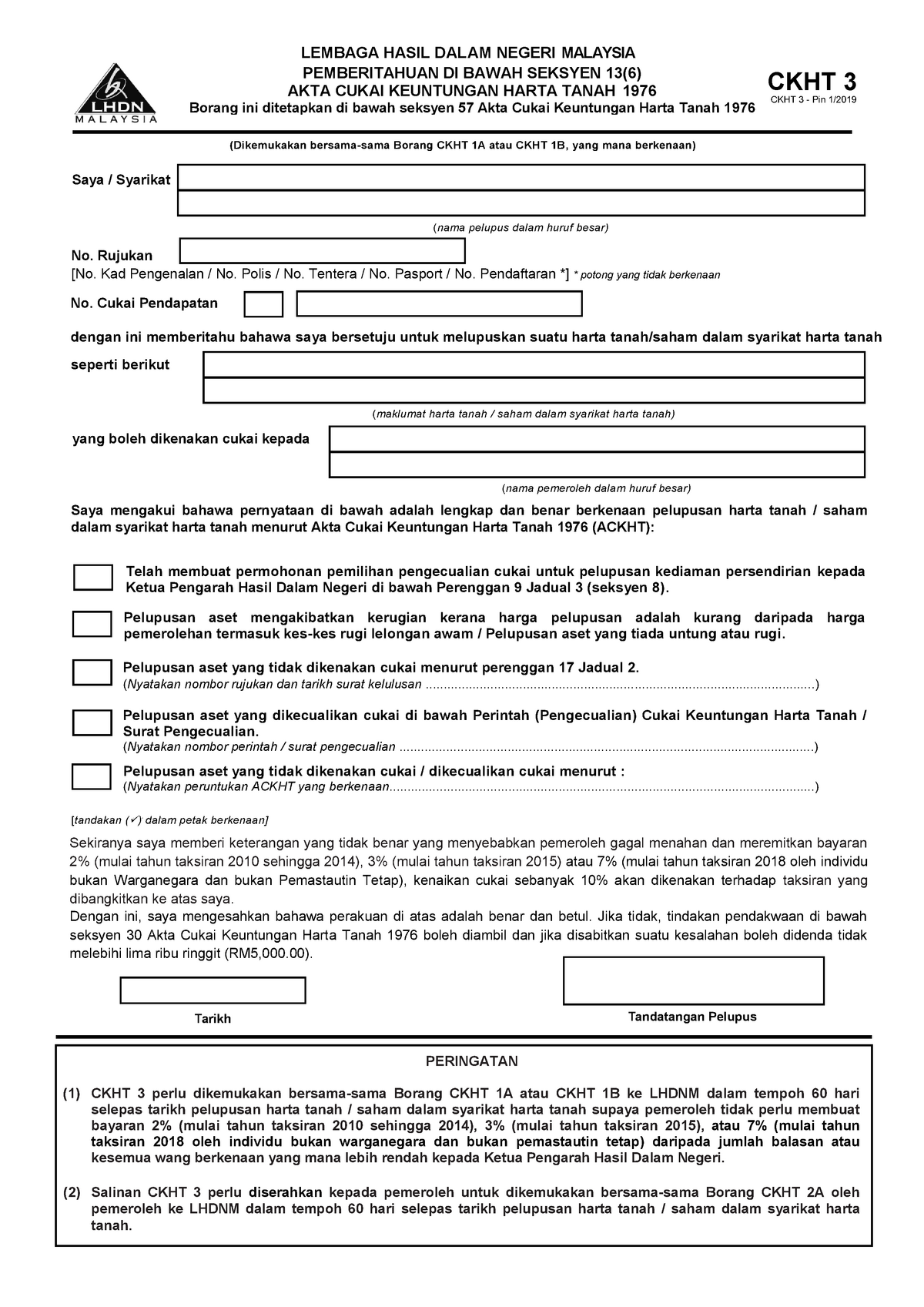

Pastikan setiap pelupus mempunyai nombor rujukan cukai pendapatan. CKHT 3 Borang AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976 LEMBAGA HASIL DALAM NEGERI MALAYSIA PEMBERITAHUAN DI BAWAH SEKSYEN 136 Borang ini ditetapkan di bawah Seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976 CKHT 3 - Pin.

Ckht 3 1 Good Ckht 3 Lembaga Hasil Dalam Negeri Malaysia Pemberitahuan Di Bawah Seksyen 13 6 Studocu

Return of acquisition of real property shares in real property company.

. CKHT 3 LEMBAGA HASIL DALAM NEGERI MALAYSIA PEMBERITAHUAN DI BAWAH SEKSYEN 136 AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976. Pastikan Borang CKHT 1A diisi dengan lengkap dan jelas. Pastikan setiap pelupus mempunyai nombor rujukan cukai pendapatan.

Ckht 1a1b ckht 3. PANDUAN MENGISI BORANG CKHT 502 Pin. Before and during the selling process he was spending about RM50000 for maintaining his property lawyer fees for sales and other miscellaneous costs which allow for exemption.

From 2015 to 2017. The 2019 Real Property Gains Tax rates are a significant factor for consideration to anyone who owns a property and intends to profit from its sale. RM800000 RM500000 RM300000 Gross Gain Net Chargeable Gain.

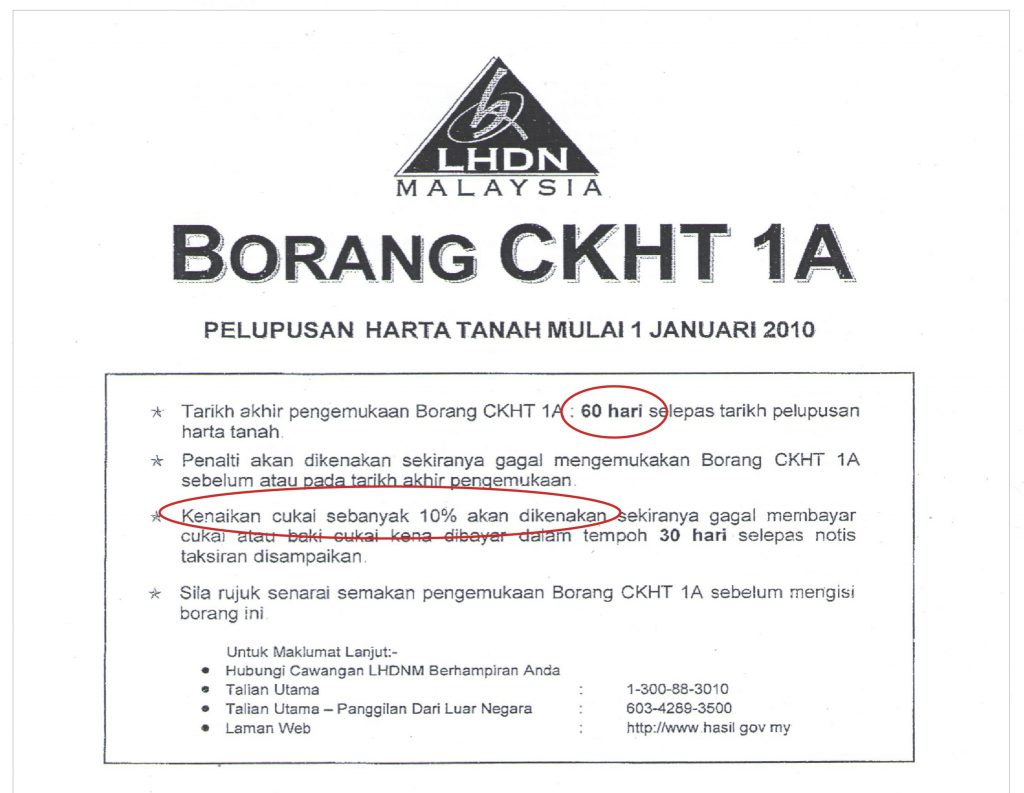

Pembayaran CKHT bagi tempoh 112010 hingga 31122011 telah diberi pengecualian melalui melalui Perintah CKHT Pengecualian No2 2009 PU. 2 Salinan CKHT 3 perlu diberikan kepada pemeroleh untuk dikemukakan bersama-sama Borang CKHT 2A oleh pemeroleh ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer dalam syarikat harta tanah. Since the passing of Budget 2019 all properties are now subject to a minimum of 5 of real property gain tax even if it is disposed after 5 years.

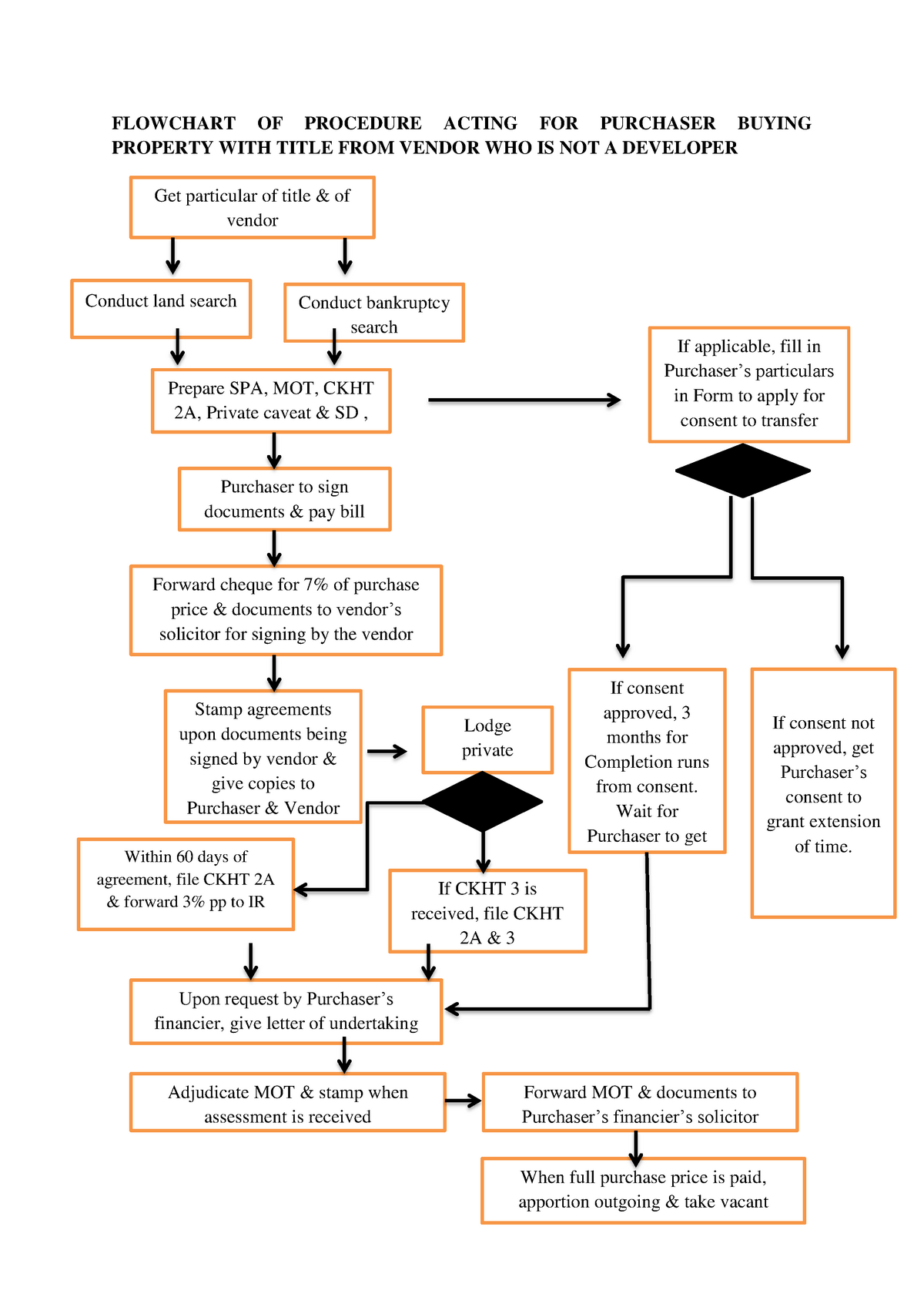

CKHT Form 502 is the form for the remittance of the 3 retention sum by the purchaser to the LHDN. 15 Isikan Lampiran 3 4 atau 5 sekiranya ingin membuat pengiraan sendiri sebagai pembelajaran cukai. As such the CKHT Form 3 is for now redundant.

Fill out a CKHT 1A Disposal of Real Property form. Mfsd2b And Spns2 Are Essential For Maintenance Of Blood Vessels During Development And Protection Of Anaphylaxis Biorxiv CKHT 1A1B CKHT 3. Malaysian Company Foreigner.

Based on Form CKHT 1A submitted by the seller the IRB will then assess the requisite RPGT chargeable and refund the balance of the 3 retention sum if any to the seller. By filling Borang CKHT 1A for the seller or disposer and Borang CKHT 2A for the. Ckht 1a ckht 1b ckht 2a ckht 3 Since the passing of budget 2019 all properties are now subject to a.

CKHT 3 perlu dikemukakan bersama-sama Borang CKHT 1A atau CKHT 1B ke LHDNM dalam. The above information is intended for educational or reference purposes only as such it should not be used to inform or. The disposal period of A would have been within 3 years ie.

14 Pengisian CKHT 3 adalah tertakluk kepada keadaan-keadaan yang disenaraikan pada borang berkenaan. Made in the prescribed CKHT 1A and CKHT 2A forms respectively to the Director If there is no tax payable prescribed CKHT 3 has to be submitted to the. 14 Isikan Lampiran 3 4 atau 5 sekiranya ingin membuat pengiraan sendiri sebagai pembelajaran cukai.

CKHT 2A CKHT 502 Sales Tax and Services Tax. Based on CKHT 3 please find the percentage table below-MalaysianLocal Company Non Malaysian. 13 Pengisian CKHT 3 adalah tertakluk kepada keadaan-keadaan yang disenaraikan pada borang berkenaan.

Dear members of the bar below are the new ckht forms for yor viewing and downloading. Pastikan Borang CKHT 1A diisi dengan lengkap dan jelas. If the seller is an individual selling the property after five years the seller or sellers lawyer will file Form CKHT 3 to apply to be exempted from the 3 retention sum.

3 10 daripada keuntungan atau rm10 000 bagi setiap transaksi yang mana lebih. CKHT 1A PDF. Borang ini boleh dimuat turun dan.

Bagi tempoh 112019 hingga 31122021 pelupus kategori Bahagian I Jadual 5 ACKHT dikenakan CKHT pada kadar minimum 5 bagi aset yang dilupuskan selepas lima tahun dari tarikh pemerolehan aset. RM300000 RM30000 10. 2 Salinan CKHT 3 perlu diserahkan kepada pemeroleh untuk dikemukakan bersama-sama Borang CKHT 2A oleh pemeroleh ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer dalam syarikat harta tanah.

Now at 2019 he sold off the property for RM800000. Sekiranya saya memberi keterangan yang tidak benar yang menyebabkan pemeroleh gagal menahan dan meremitkan bayaran. Along with this you have to include the sale and purchase agreement.

Dengan ini memberitahu bahawa saya bersetuju untuk melupuskan suatu harta tanahsyer dalam syarikat harta tanah. 3 order 2020 and stamp duty exemption no. Borang ini ditetapkan di bawah seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976.

You may also include any other. Sekiranya saya memberi keterangan yang tidak benar yang menyebabkan pemeroleh gagal menahan dan meremitkan bayaran. Latest 2019 RPGT Rates in Malaysia.

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Flowchart Of Procedure Acting For Purchaser Buying Property With Title From Vendor Who Is Not A Studocu

Tax Return Pictures Download Free Images On Unsplash

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Cukai Keuntungan Harta Tanah Portal Jabatan Penilaian Dan Perkhidmatan Harta

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa